Savvy Investment Tactics: Incorporating Bitcoin and Celo

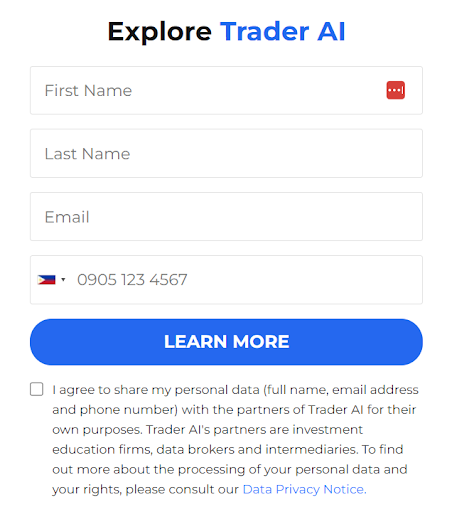

In the dynamic realm of investment, digital assets, notably Bitcoin and Celo, have become prominent players. This article seeks to elucidate the intricacies of strategic investment, offering a comprehensive exploration of the realms surrounding Bitcoin and Celo. Its objective is to furnish investors with valuable insights to navigate the ever-changing market effectively. See image below.

Understanding Bitcoin: A Pillar in Digital Asset Investing

Bitcoin, the pioneer of cryptocurrencies, has witnessed a remarkable journey since its inception in 2009. Its decentralized nature, finite supply capped at 21 million coins, and the underlying blockchain technology contribute to its unique value proposition. Investors are drawn to Bitcoin not only for its potential for substantial returns but also as a hedge against traditional market volatility.

Despite Bitcoin’s resilience and widespread adoption, misconceptions and risks abound. Common concerns include regulatory uncertainty, environmental impact, and its perceived use in illicit activities. It is crucial for investors to understand these factors and make informed decisions based on a thorough analysis of Bitcoin’s fundamentals.

Unraveling Celo: A Promising Contender in the Crypto Space

Celo, a relatively newer entrant to the cryptocurrency scene, offers distinctive features that set it apart. Built on the principles of accessibility and financial inclusion, Celo aims to create a more inclusive financial system. Its focus on mobile-first solutions and stability mechanisms makes it an intriguing investment option.

Comparing Celo to other cryptocurrencies, including Bitcoin, reveals its unique value proposition. Celo’s emphasis on usability and stability mechanisms positions it as a potential contender for mainstream adoption. However, investors should carefully assess the risks associated with newer projects and consider factors such as liquidity and market acceptance.

Synergies and Diversification: Integrating Bitcoin and Celo

Diversification is a cornerstone of sound investment strategy, and the cryptocurrency realm is no exception. While Bitcoin and Celo have distinct features, they can complement each other in a well-structured portfolio. Bitcoin, often dubbed “digital gold,” provides stability, while Celo introduces the potential for innovation and growth.

Balancing the benefits and challenges of incorporating multiple digital assets is essential. Real-world examples highlight successful portfolios that leverage both Bitcoin’s stability and Celo’s growth potential. This synergistic approach can enhance risk-adjusted returns and mitigate the impact of market volatility.

Navigating Market Volatility: Risk Management Strategies

Cryptocurrency markets are notorious for their volatility, posing both opportunities and challenges for investors. Acknowledging this inherent risk is the first step toward devising effective risk management strategies. Techniques such as setting clear investment goals, diversifying across assets, and employing stop-loss orders can help mitigate potential losses.

Understanding market sentiment, staying updated on industry news, and utilizing technical analysis tools are crucial for navigating the unpredictable nature of crypto markets. Real-life case studies underscore the importance of a disciplined and informed approach, demonstrating how risk management can be a key determinant of long-term success in digital asset investing.

Regulatory Landscape: Staying Informed and Compliant

As the cryptocurrency market matures, regulatory scrutiny intensifies. Investors must navigate the evolving regulatory landscape to ensure compliance and mitigate legal risks. A comprehensive overview of current regulations surrounding Bitcoin and Celo, along with the global perspectives on cryptocurrency regulations, provides a foundation for informed decision-making.

Staying abreast of regulatory developments is paramount, as shifts in policy can significantly impact the crypto market. Investors should adopt a proactive approach, incorporating compliance measures into their investment strategies and seeking legal counsel when necessary.

Future Trends and Opportunities: What Lies Ahead

The future of Bitcoin and Celo is shaped by emerging trends and technological advancements. As blockchain technology continues to evolve, so do the opportunities for growth and innovation in the cryptocurrency space. Investors should keep a keen eye on developments such as decentralized finance (DeFi), non-fungible tokens (NFTs), and scalability solutions that can impact the trajectory of these digital assets.

Expert predictions offer valuable insights into the potential catalysts for growth and mainstream acceptance. As the industry matures, opportunities for strategic investments may emerge, making it essential for investors to stay informed and adaptive to the ever-changing landscape of digital asset investments.

Conclusion

In conclusion, the integration of Bitcoin and Celo into an investment strategy requires a nuanced understanding of each asset’s unique characteristics. As pioneers in the cryptocurrency space, Bitcoin provides stability, while Celo introduces innovation and inclusivity. By leveraging the synergies between these assets, diversifying effectively, and implementing robust risk management strategies, investors can position themselves for success in this dynamic and evolving market. Staying informed about regulatory developments and anticipating future trends further enhances an investor’s ability to navigate the complexities of the cryptocurrency landscape. As we look ahead, the future of savvy investment tactics in the world of Bitcoin and Celo holds promise, but success requires diligence, adaptability, and a commitment to staying ahead of the curve.