Form 4868 Online Free {April 2022} The Recent News!

This article provided information regarding form 4868. Please read all the information before applying for Form 4868 Online Free.

Do you know that you can apply for a date extension for submitting your return? In 2022 due to some reason and case, few people face problems paying taxes on a date as per the Government agreement in the United States.

So, the IRS developed a form where you can apply for delayed payment of service tax from the original date. Therefore, you have to follow certain rules and norms to apply for this Form 4868 Online Free. So let’s find out how this form is helpful.

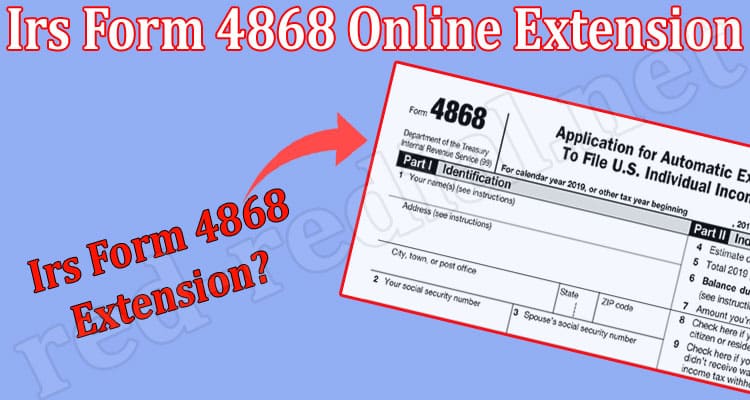

About Form 4868.

For the year 2021, the tax submission date is 15 April 2022, but if you are not able to pay your tax by that time, you can apply for a date extension to file your return.

Form 4868 is developed where you can fill in your stats and request for date extension. Now you can visit the official website of the IRS to submit a file or extension date for return. Moreover, this form is completely free to fill.

Irs Form 4868 Online Extension.

Internal revenue service (IRS) provides help to those who are not able to submit their tax return on time due to some major issues. If you have any remaining due of previous years, you have to pay them by 18 April, or you will be charged with interest or penalty.

Form 4868 will be available online for free to all the tax buyers.The IRS form 4868 can prevent you from paying penalties that can charge you up to 25% if you cannot pay the return on time. If you are not applying for IRS form 4868 and return, you have to pay 5% of your return upto 25%.

How to Use Form 4868 Online Free

Form 4868 can be filed in various ways. It can be done in 2 ways: current customers and new customers. For current customers: first, you have to make an account, then you have to log in with that account further, you have to fill in all the information required to apply for an extension, and you can now apply for a return extension.

For New customers: if this is your first time to return and you are not able to submit your return on time, you can apply on “Start a new 2021 tax return” after that, you can make an account by which you can File Irs Extension Form 4868 Online. So by all this process, you can easily avoid interest and penalties to your return if you are unsuccessful in paying it on time.

Conclusion

Form 4868 is very helpful for all those unable to submit their return on time. You can apply on this form to get an extension date. Furthermore, all information on applying for form 4868 is in this article. Did you find this form helpful to mention in the comment section below? You can visit the IRS official website to apply for Form 4868 Online Free by clicking on.

Also Read :- Irs Form 4868 Online Extension {April} Explore Criteria!