Financial Advisor and Financial Planner Are the Same or Not?

People typically see a professional when they need help managing their money. Both financial planners and financial advisers are experts who help customers manage their money.

There are many different types of financial experts, including brokers, financial planners, and investment gurus in addition to accountants and insurance agents.

All financial advisers are a type of financial planner, even if not all of them are considered to be such. A financial adviser may possess more than 100 certifications.

A Financial Advisor: What Is It?

A financial adviser has completed the qualification and license tests required to offer advice on investments and money concerns.

Financial consultants can support their customers with a range of financial choices, such as saving for retirement, purchasing a property, or making business investments.

They can also help customers with estate planning and obtain insurance coverage, however, you should still have an attorney create any wills or trusts.

Perhaps one of them will advise you to take payday loans online same day deposit near me to improve your financial situation.

There are several different sorts of consultants, and each one provides a unique set of services and strategies — as well as their particular areas of expertise. Most have succeeded on certain licensing tests.

This is normally the Series 7 Exam, or sometimes the Series 65 Exam, administered by the Financial Industry Regulatory Authority (FINRA) (required for registered investment advisors). Though not all of them do, some financial counselors are also financial planners.

For their services, financial advisors often demand an annual fee. Some also charge commissions for the goods they offer, including annuities and mutual funds.

Although there is a wide range of these costs, yearly fees frequently fall between 0.5% and 1% of the assets under management (AUM), with commissions reaching as high as 6% of transaction amounts.

A Financial Planner: What Is It?

With a comprehensive approach to financial planning, an independent financial planner will consider the “whole picture” of your money.

A financial planner will assist you in determining what you want out of life and in developing a financial strategy to make it happen. In addition, the SEC has developed tips to help you make the final decision about which financial professional is best for you.

The main distinction between a financial planner and a financial adviser is that the former is more concerned with you and your objectives, while the latter is more concerned with your money and investments.

To develop a comprehensive plan for your money, financial planners draw on their knowledge of taxes, budgeting, pensions, and investments.

By putting your money under your control and giving you clarity and assurance about your financial future, working with an independent financial planner may help you.

An individual’s financial future can be mapped out through a financial plan that a financial planner will develop.

Your current situation, your desired state, and a plan to get there will all be laid out in your financial plan.

Financial products like ISAs and pensions may be a part of the financial plan, but they are only implemented.

Which One Fits You Best?

Planners and financial advisors both have their uses in specific situations. Interestingly, artificial intelligence can act as a financial expert.

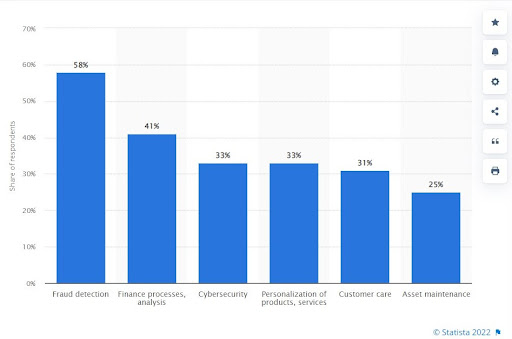

According to Statista, 41% of respondents will use artificial algorithms for financial processes and analysis.

AI use cases in financial services industry worldwide as of 2020

No matter who you choose to work with you on your finances, be sure to follow these simple guidelines to keep yourself safe and get the most for your money:

- Ask your friends and family for suggestions, but also do your independent assessment by speaking with them and asking plenty of questions.

- Never hire someone without first researching their credentials, background, and whether any complaints have been filed against them.

- Ask them to be specific about their compensation, including the method of payment and if they will receive payment from anybody else for their efforts on your behalf.

- Ask them if they are authorized to offer you the investment if you plan to use them to make investments, and then confirm their representations.

What Qualities Should a Financial Planner and Adviser Have?

The objectives of a financial adviser and a financial planner differ slightly, but when it comes to what you look for in employing either, they are comparable. The qualifications of your potential adviser or planner should be taken into consideration.

Financial services industry experts advise consumers to seek out professionals with recognized certifications and steer clear of those who lack them because almost anybody can declare themselves to be a financial counselor or planner.

A person with an official designation has met certain educational and experience requirements, such as passing a certain exam. A planner or advisor without these credentials may have cheated on tests and training.

Particular Considerations

A financial planner, a more specialized kind of financial counselor, is typically hired by those who require financial assistance. However, some research is needed before choosing the “kind” of a financial planner.

It’s crucial to do your homework and look into a planner’s qualifications before employing them to assist you with your money.

Make careful to inquire about the planner’s specific education and experience, such as if they focus on tax or estate planning.

Clients should be aware of the financial planner’s compensation structure and the benefits they will get. For instance, is the financial review subject to a one-time cost or are there repeated fees assessed each time an investment is changed or a plan update is made?

Additionally, it’s critical to confirm that your planner’s investment suggestions and decisions match your risk tolerance and long-term financial goals.

When evaluating a financial planner, think about creating a list of inquiries. Check the planner’s references and disciplinary history to be sure you’re getting the highest caliber financial advice.

It’s crucial to remember that all professionals who provide retirement planning advice or design retirement plans are subject to a specific legal and ethical standard under the new fiduciary rule from the U.S. Department of Labor.

Conclusion

When you’ve decided between a financial planner and a financial adviser, you’re ready to look.

Choose a few qualified applicants from your list of alternatives, create a list of questions to ask them, and then arrange appointments. Inquire about their experience, credentials, average clientele, pricing schedule, investing philosophy, and services offered.

Verify their references and disciplinary history to ensure they are in good standing. A good adviser should be competent, accessible, honest, and likable.